Cost Savers

Cost Saver

COST SAVER is a unique way to increase the bottom line. Yes, you can increase sales for sure, but you can also implement a management program that specializes in cost-cutting measures to your advantage.

In the face of ever-increasing costs, cost-saver is an easy way for employers to start examining major programs that harm their overall business performance.

When a company decides to adopt the cost-cutting philosophy as part of their business agenda, they need to have a clear view of their objectives and identify the good and bad costs before implementation.

Knowing that there are good costs and bad costs in every business is critical when taking the first step toward change. Those not aligned with growth strategy are bad, while those that support overall growth initiatives are good.

Tactically, one needs to look at the organization as a whole and differentiate between the critical good costs and the non-essential elements of the bad costs before taking action.

When embraced, these cost-effective options will begin to change your business model as they are designed to empower a cultural movement within your own company that brings awareness and a trickle-down-effect to dedicated employees who seek to manage and control their budgeted costs under a new corporate philosophy.

Surveys indicate that 8 out of 10 small businesses fail to control costs, and while most companies focus on increasing sales from month to month, they lose sight of lowering expenses which can be equally as important when trying to achieve or maintain profitability.

Because of the volatility of market swings, it makes it difficult for business owners to predict what their profitability should be, not to mention that profit margins come in multiple dimensions with added complexities. So what is your ideal profit margin and what margin is most relevant to your needs?

While you can’t force your customers to spend money, some variables can affect net profit margins which can be controlled or influenced under our cost-saver strategy by finding new ways to trim unnecessary costs, ultimately leading to a marginal increase.

So how does an employer find new ways to slash costs?

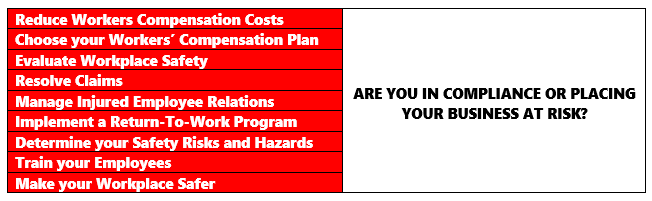

Safety would be a good place to start, and those in the industry know that workplace injuries and fatalities are real events that can’t be eradicated simply by pushing a button.

Notably, not only do these injuries affect your employees, but they affect your bottom line. According to the “Liberty Mutual Workplace Safety Index” businesses in the United States spend more than a billion a week on the most disabling workplace injuries, and although you can’t prevent every injury from happening, you can take proactive measures to lessen the risk of work-related injury or death.

The Implementation of an educational program or on-the-job safety training would be essential in this case. To understand the value of this type of program, look no further than OSHA (Occupational Safety and Health Act). Under the Act, employers are required to implement safe work practices that remove harmful hazards and risks from all areas that may lead to employee injury. By ignoring the Act and not having safety training programs in place could result in unexpected fines.

Safety training will help to reduce the cost of insurance and workers’ compensation claims. A study conducted by California’s Division of Occupational Safety and Health in 2012, found that those organizations that participated in workplace safety programs saved approximately $355,000 in injury claims and compensation over the survey period.

As a business owner, you have many responsibilities, and one is to protect your company against potential personal injury litigation awards arising from claims filed by employees alleging that you or a hired employee negligently caused their injury on the job. By having workers’ compensation and internal training, signals that your business is prepared to do the right thing for employees on its own, without being forced to do so through litigation or outside sources.

The cost-saver technology works in multiple areas, it’s endless, but imagine what you could do with thousands of dollars added to your net profit if you found a firm that could provide a cost reduction analysis that identifies ways for you to cut costs and increase your cash flow and net profit.

To improve safety, each employer should examine the root causes of the most serious workplace injuries they experience, and the ways to effectively mitigate them through training, and work design programs to reduce risk of injury.

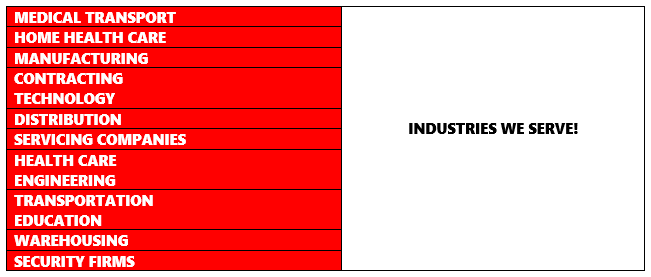

Our team can present identified cost savings reduction analysis, strategies, recommendations, and training. We can assist you in acting on these cost savings opportunities, and in many cases, can act on your behalf to implement them. Our methodology to reduce costs is intense, precise, and detailed, and we will go far beyond in conducting our research while passing those cost-saver benefits on to you.

Average Annual Costs

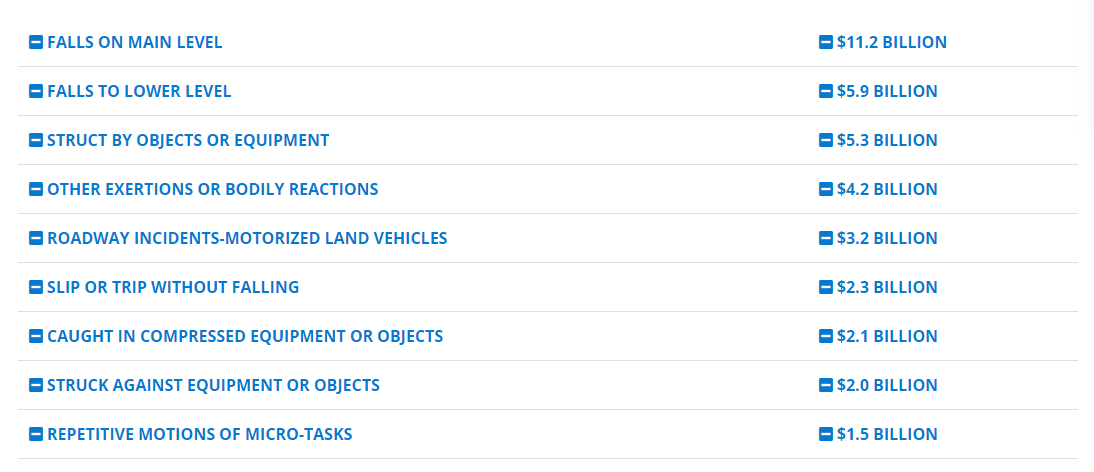

Overexertion involving outside sources was the leading cause of disabling injuries for the fourth consecutive year, costing employers a staggering $13.7 billion. Other causes and related costs were:

Cost Saver Strategies

-

Establish a line of credit to help you through slow periods.

-

Offer your customers multiple payment options by accepting direct deposits or credit cards, or spreading vendor payments out so they fall within the slow season.

-

Consider other alternative funding options outside traditional lending institutions that temporary boost cash flow such as factoring, equity financing, or vendor financing arrangements.

-

Negotiate with your vendors or suppliers for a discount or extended payment terms that better suit your business needs.

-

Review your fixed and variable costs by finding a strategy that reduces costs when cash is tight or examining cost-reduction measures to variable costs related to business activity by finding a lower-cost supplier for products or fluctuating costs like advertising or third-party services.

-

Scrutinize your products or services to determine which are the most or least cost-effective. Cut back or eliminate those that least profitable and invest in those products that are the most lucrative.

-

Lease instead of purchase will free up additional funds to run your company.

-

Slowing down and delaying payments is a strategic move that keeps your money in-house longer.

-

Use the downtime constructively by looking for new opportunities to generate revenue by marketing your business more aggressively.

-

Lower advertising costs on established product lines and use the savings on marketing campaigns to diversify and expand new products.

-

Refinance long-term debt on equipment and machinery, especially when rates are low.

-

Share marketing expenses that compliment your products and negotiate mutual marketing arrangements.

-

Maintain equipment in-house if your third-party repairs and maintenance are significant and hire a mechanic or specialist who can regularly service equipment.

-

Create a monitoring policy for tools and equipment that are often overlooked and are invisible consumables that are misplaced, lost, or borrowed from the workplace.

-

Invest in permanent training programs and promotional systems.

Product Types & Services